Asset Protection Strategies

|

Asset protection is the adoption of advance planning techniques that place one's assets beyond the reach of creditors. It does not involve fraudulent or illegal activity. It is based upon proven sophisticated combinations of business and estate planning techniques. The methods employed include the use of financial products and legal structures domestically and offshore.

There are two general objectives behind asset protection strategies. One is to place assets beyond the reach of creditors, through the creation of legal structures or relationships. Another is to position those assets to deter creditors from pursuing those assets or to hinder their ability to successfully pursue them. Except in extremely limited and well-defined circumstances (e.g. bankruptcy or federally backed loans) there are no penalties, either civil or criminal, for engaging in asset protection. It is important to implement a asset protection plan before any claims arise. Think of it like getting a flu shot. If you get a flu shot before flu season then you will most likely not be affected by the flu but the more into flu season you wait, the more likely you are to contract and fall ill to the flu. At Private Client Advisers we focus on creating the right Asset Protection Plan for you based on you financially specific and ever-changing needs. |

What Asset Protection Strategies does Private Client Advisers Offer?

Private Client Advisers uses everything from Blind LLC's to Equity Management to create a Financial Fortress and keep your assets out of reach.

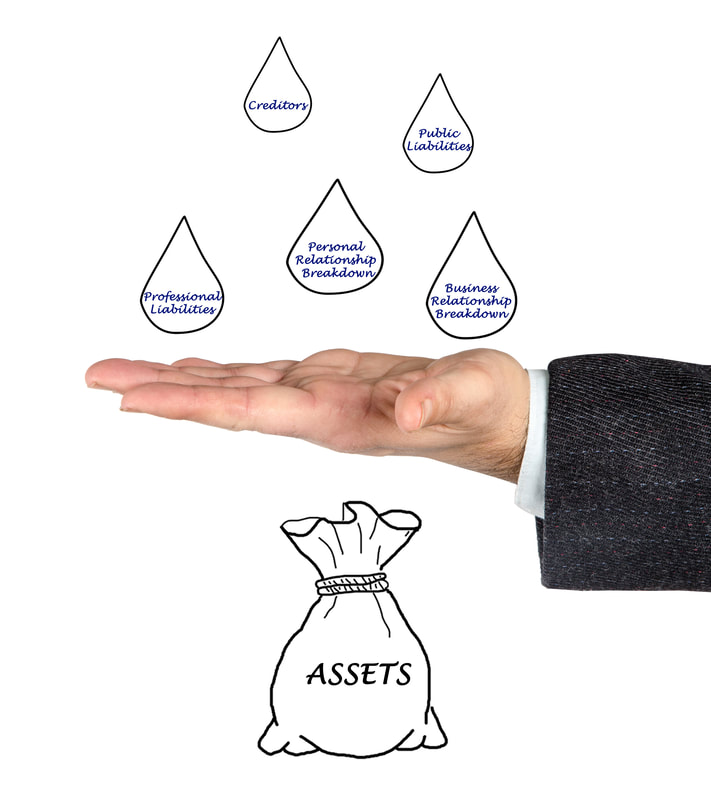

Our Financial Fortress Architect™ will show you how to build a financial fortress around your assets to protect them from frivolous litigation and other hazards that threaten to take away years of hard work and sacrifice.

The time to start your asset protection planning is right now, before “legal storm clouds” appear above your head.

Our Financial Fortress Architect™ will show you how to build a financial fortress around your assets to protect them from frivolous litigation and other hazards that threaten to take away years of hard work and sacrifice.

The time to start your asset protection planning is right now, before “legal storm clouds” appear above your head.

Family Limited Partnership:

The Family Limited Partnership is an extremely useful device for accomplishing a variety of asset protection objectives as it allows you to maintain control and management over family assets without having an interest that can be seized by a creditor. Assets that have been transferred to the FLP cannot be reached by a creditor unless he can demonstrate that the transfer was a fraudulent conveyance.

Rather than reaching the assets in the FLP the creditor is limited to a remedy known as the charging order. This is a court ordered charge that any distributions to be paid to the debtor partner be paid to the judgment creditor instead. The judgment creditor does not acquire any other rights to profits or management of the partnership. If the partnership does not make any distributions during the term of the charging order, the creditor will not receive any payments. Because the creditor cannot reach the assets of the partnership and must wait for distributions, family assets will be successfully protected. However, with a charging order, the creditor will still be liable for the tax on the profits of the debtor partner, even if the creditor has not received any distributions.

When the Family Limited Partnership is used in conjunction with a domestic or Asset Protection Trust, which holds the limited partnership interests in the FLP an even more significant level of protection is achieved. Limited Partnership interests held by the trust will not be subject to a charging order or foreclosure because these interests are no longer "owned" by the debtor partner.

Rather than reaching the assets in the FLP the creditor is limited to a remedy known as the charging order. This is a court ordered charge that any distributions to be paid to the debtor partner be paid to the judgment creditor instead. The judgment creditor does not acquire any other rights to profits or management of the partnership. If the partnership does not make any distributions during the term of the charging order, the creditor will not receive any payments. Because the creditor cannot reach the assets of the partnership and must wait for distributions, family assets will be successfully protected. However, with a charging order, the creditor will still be liable for the tax on the profits of the debtor partner, even if the creditor has not received any distributions.

When the Family Limited Partnership is used in conjunction with a domestic or Asset Protection Trust, which holds the limited partnership interests in the FLP an even more significant level of protection is achieved. Limited Partnership interests held by the trust will not be subject to a charging order or foreclosure because these interests are no longer "owned" by the debtor partner.

Domestic Asset Protection Trust:

A domestic asset protection trust is a trust established and operated by a trustee that is in the same jurisdiction as the settlor. For a person residing in the United States, that is a trust established and managed in one of the US states. These legal tools are established in jurisdictions with laws that allow such trusts. They are set up for the purpose of sheltering assets and to keep them from being taken by judgment creditors in court proceedings. You have probably heard of individuals setting up asset protection trusts to keep their hard-earned money from being taken in lawsuits. Trusts set up for asset protection domestically are in contrast to those those which use foreign trust statues and trustees. Settlors can use a domestic of offshore trust to shield money and other assets from creditors.

Foreign Asset Protection Trust:

A popular alternative to the domestic trust is a Foreign Asset Protection Trust (“FAPT”). A FAPT is one that is established under the laws of a foreign country and provides certain advantages which cannot be achieved with a domestic trust. Certain countries such as the Cook Islands and Nevis have laws that are much more favorable to asset protection than the laws in the United States. By creating a trust under the laws of one of these jurisdictions an individual can obtain greater protection and flexibility than is available for trusts formed under U.S. law.

In using the FAPT, the individual does not sacrifice any degree of immediate control and access to his property. All bank accounts and real estate remain in the family limited partnership. Only the interest in the family limited partnership is transferred to the trust. The individual, as general partner of the family limited partnership, retains total authority over his property.

If a creditor attacks this structure, the family limited partnership can distribute its liquid assets and personal property to an offshore account that has been established in the name of the trust. This feature provides the ultimate protection for family assets since this account will not be subject to the jurisdiction of a U.S. Court. Once assets have been safely relocated under the protection of the laws of that country, recovery of the funds by the creditor becomes unlikely.

The tax rules governing these kinds of trusts are identical to those concerning the domestic trust. Properly structured, there are no gift tax consequences to the arrangement and all income of the trust is reported directly on the return of the settlor.

In using the FAPT, the individual does not sacrifice any degree of immediate control and access to his property. All bank accounts and real estate remain in the family limited partnership. Only the interest in the family limited partnership is transferred to the trust. The individual, as general partner of the family limited partnership, retains total authority over his property.

If a creditor attacks this structure, the family limited partnership can distribute its liquid assets and personal property to an offshore account that has been established in the name of the trust. This feature provides the ultimate protection for family assets since this account will not be subject to the jurisdiction of a U.S. Court. Once assets have been safely relocated under the protection of the laws of that country, recovery of the funds by the creditor becomes unlikely.

The tax rules governing these kinds of trusts are identical to those concerning the domestic trust. Properly structured, there are no gift tax consequences to the arrangement and all income of the trust is reported directly on the return of the settlor.

Equity Management Mortgage®

This is a method of “equity stripping”, meaning that you maintain control and ownership over the property, but have no equity available for creditors. The mortgage is structured like any conventional mortgage, giving the mortgage company has the first position in the property. Debts to the mortgage company would have to be satisfied before the creditor has any claim on the property. Thus, if a property is highly mortgaged, there will be no equity left available to a creditor. McKenzie-Finch’s mortgages, however, can be structured as “friendly mortgages” whereby, although structured as an arms’ length transaction with a neutral third party, they are funded by offshore entities that the client controls. Thus, the client gains additional asset protection and investment advantages.

Asset Protection FAQ:

At Private Client Advisers we create Asset Protection Plans that are custom fit to all our our clients needs and goals. We are always happy to answer any questions you may have about the different strategies that we employ. We have also created a resource for frequently asked questions.

|

|

|