Holistic Three Dimensional Planning

It is not uncommon for clients to hire a consultant to solve an income tax problem, only to find that their advisor created an estate tax or asset protection problem. Unfortunately, most clients do not discover this until it is too late. Private Clients offers you holistic, three-dimensional planning that takes into consideration all of your needs, financial goals and circumstances before making a recommendation. This is a technique that is exclusive to Private Client Advisers and allows us to not only plan for your current financial challenges but any future challenges as well.

"One ounce of prevention is worth a pound of cure"

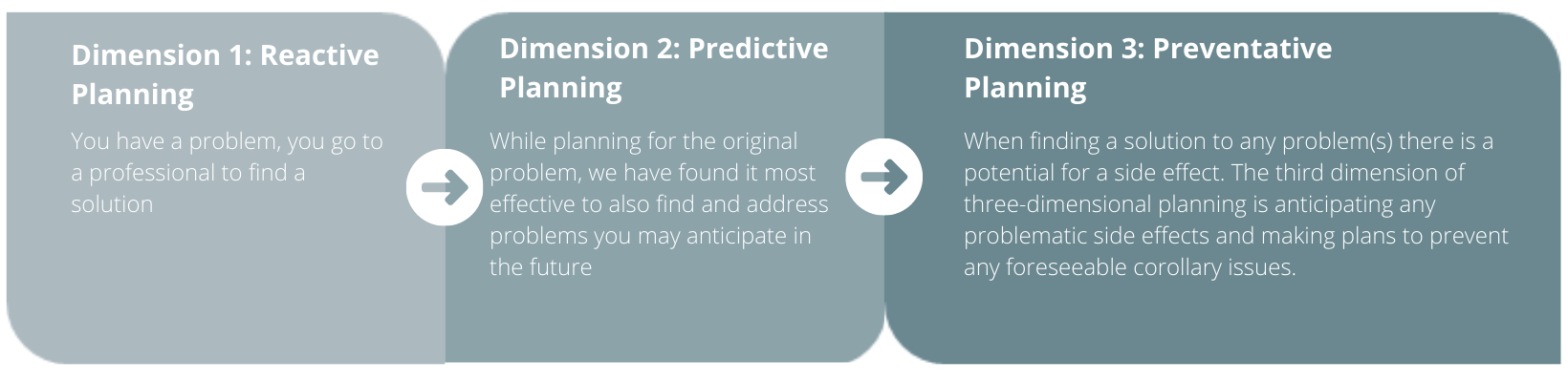

The First Dimension is Reactive Planning

Reactive Planning is the most common type of planning for us or any other type of professional advisor (CPA, Attorney, Financial Advisor, etc.). This is simply the first step of any planning strategy where you have a problem and we find a solution. Most other advisors are going to do a great job with this dimension, however, most of your advisors will stop after this step is complete.

The Second Dimension is Predictive Planning.

Predictive Planning is a technique that we have created to look beyond your Reactive Problem by looking at the other areas of your financial life that may need attention to create a holistic plan. This helps us design a more well rounded plan that can cover the problems that we can anticipate in the future.

The Third Dimension is Preventative Planning.

We have realized through years of planning for clients that with every solution there is the possibility of a side effect. We use our Preventative Planning technique to explore any problematic side effects that may arise in the future and start to do some pre-planning to have a strategy to prevent any of those foreseeable corollary issues.

|

|

|